Psst… I used to think not having a steady paycheck was the scariest thing in the world.

In this article, I’m sharing how I wrapped my head – and my bank account – around quitting my six-figure job and leaping full-time into self-employment.

Preface: My journey is unique. So is yours.

Before we get into it, I want to preface by saying that this is not necessarily one of those “this is how I did it, so you can do it too” types of things. That’s bullshit. Maybe you can’t, maybe your situation is different, or maybe you can but in a totally different way.

I will be the first to acknowledge that I have had a ton of opportunities. I’ve been really blessed in my career. I’ve had a lot of success, financially and otherwise, that put me in a position to make this move. And not everyone has those privileges, those opportunities, or those advantages.

So I’m not saying, “Oh, this is how I did it, and it was so easy. Just follow my steps, and you can do it too.”

Your situation or circumstances may be completely different, and that’s okay! But there may be some things you can learn along the way. I get asked about this a lot, so I hope there’s something valuable in my story that can be helpful to you.

Plus, I think it’s important to talk about money, even if it’s awkward and uncomfortable.

We’re never taught about money, and I think that’s terrible. So I’m all about talking about it, being transparent, getting used to talking about it, and normalizing that so that we can learn how to make more of it because money is power.

The Background

A Lifetime of Money Fears

Growing up, I kind of had two different childhoods. First, there was pre-divorce where we had no money, and that ingrained kind of like a scarcity mindset and a real fear of financial instability. Then, my parents split up, my mom remarried, and we were definitely more secure. But my stepdad is a business owner, so I experienced firsthand that roller coaster of not knowing when you’re going to get paid.

So, even though we were much more comfortable, I still had fear around not having enough for the next ten years of my life. For that reason, I was super financially risk-averse. I never thought I would own a business; I just thought it would be too financial stress. It seemed so far-fetched to me.

Working Up the Corporate Ladder

So I worked at a branding agency for about ten years. I started as an unpaid intern, and by the time I left, I had just hit six figures. I then worked at a financial company for two years as in-house Creative Director, and it was a game-changer.

This is one of those moments that I acknowledge may not be typical: they paid really well. There were a lot of incentives, bonuses, and great benefits. It positioned me to make the move that I did. Without that job, I don’t know if I would have been able to, or it certainly would have taken me longer or been a different route. As I said, not everyone is going to have that, but that’s just the reality for me.

Living Below My Means

I’m generally pretty frugal; I don’t spend a ton of money on stuff. While LA is expensive, I have a pretty simple lifestyle. My one vice is travel, but I’m great at traveling on a budget. So, I’ve always had a good amount of disposable income from living below my means. And like I said, I was making a good salary at that time, which made that easier.

Let’s get into how I actually made the move.

From Six Figure Salary to Self-Employed in 6 Steps

Step 1: I set the goal

In October 2018, I led a goal-setting workshop where I set the goal to quit my job in a year. I didn’t have much of a reason for that timeline; It was pretty arbitrary. But my lease would be up at the end of 2019, so I just went with that.

Step 2: I paid off my debt

Between student loans and a car loan, I had about $60-$70k in debt total.

But by the time I set the goal to quit my job, I had already been focusing on paying off my debt for a couple of years. [See 12 Game-Changing Things I Learned About Money]

I knew that getting out of debt gives you freedom to take on new opportunities–whether that’s leaving your job, that’s taking a different job, going and traveling for a year, etc. It just lessens your obligations and your burdens.

So I ended up paying them off in December 2018, shortly after setting the goal.

How did I do it?

- I refinanced and consolidated my loans, which lowered my base payment.

- I made the largest monthly payments I could swing.

- I put every extra bit of income (bonus, tax return, side hustle $, etc.) straight towards my loans.

I started to see the balances drop each month. When I finally mailed the check to pay off the final balance, the feeling was amazing. I felt so free!

This may not be necessary for you. You may not have loans, and if you do, you don’t necessarily have to pay them off before you leap into running your own business. Doing so just gives you a little bit more wiggle room and lowers the stakes because you have fewer monthly payments or fewer expenses to worry about in general.

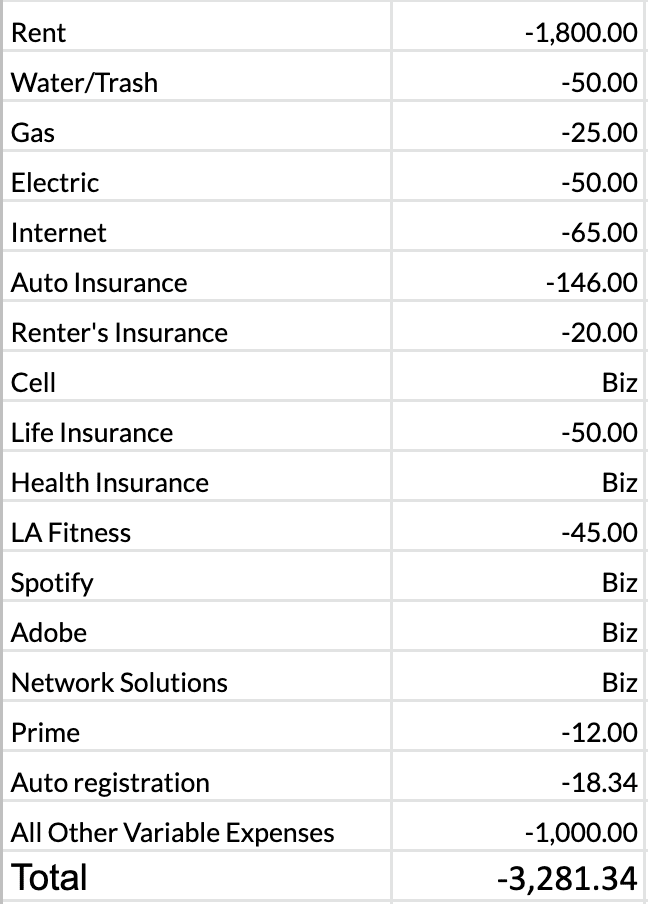

Step 3: I made a budget

My next step was to plan my baseline budget. I wanted to know exactly how much I needed to survive each month, in the worst case scenario that I didn’t have any money coming in.

List all your expenses

I am an active budgeter, so I was already aware of my expenses. But for this survival income exercise, I focused on the bare minimum: utilities, essential bills + basic living expenses like food, gas & the gym. Your essentials may be different than mine.

I didn’t include any savings or financial investments, figuring that if necessary, I could skip those on a temporary basis.

Figure out what your business will pay for

A business has many advantages in terms of expenses. Healthcare? A business expense. My phone? A business expense. Work from home? Guess what? Part of your rent is now a business expense. You can plan for those things and how you can optimize them tax-wise to keep more of your money and cut back on your personal expenses by paying them with your business and writing them off (some of them, at least).

After all this, my survival income was less than I expected: about $3k a month.

In reality, by the time I made the leap, my boyfriend and I had moved in together so that cut the expenses down even further. But I based my financial plan on being fully independent 🙂

Step 4: I saved up a safety net

Now that I knew exactly how much it would cost me to live, I wanted to save up a safety net that would cover several months–just in case. As I said, I’m very financially risk-averse.

SUPER SAVER

I already had about 6 months of living expenses saved when I started planning to quit. But then I really stepped it up. I saved super aggressively during that one year of planning. I said no to all kinds of stuff and made sacrifices to save as much as possible. Every time my savings account grew, it chipped away at my financial fears.

DON’T OVERDO IT

Honestly, I ended up over-doing it and saving about two years’ worth of expenses. While that wasn’t necessary, it certainly gave me a lot of peace of mind. But in the long-run, that money is better served in some type of investment than sitting in a savings account, so now that I’m in a stable place, I’ve put it into real estate.

You definitely don’t need to build as big a safety net as I did. Six months’ worth is a good rule of thumb! It’s all about what you feel comfortable with and how much revenue you’re going to be bringing in at the get-go.

Step 5: I built a revenue stream

In the year before I left my job, I launched my business, and I started getting clients. My focus was to do as much work and make as much money as I possibly could at that time to work on that big safety net.

I did like 25 projects in that year which was A LOT, but they were pretty much all one-time clients. So, that didn’t necessarily help me set up for the future.

FOCUS ON LEAD GEN

In hindsight, I should have shifted my focus. I wish I had focused more on building the systems, processes, and relationships that would get me consistent leads for the long term.

My advice is to focus on how you’re going to get repeatable business or consistent leads or sales coming into your business.

BALANCE REVENUE + SAFETY NET + EXPENSES

I did not take the common, well-advised guidance to only leave your job when you have fully replaced your income. I knew that would never happen (ok, hopefully not never), buy my income was high, so I wasn’t going to replace it anytime soon.

That said, the more you build up your revenue through your new business, the less of a safety net you need and the less you need to worry about paying off your debt.

I went ham on all of those things because I’m super cautious, but you need to find the right balance for you. Many people have a business that completely replaces their current income, and in that case, you don’t need to worry about having the debt paid off or having the huge, ridiculous safety net. It’s just whatever works for you.

Step 6: “I QUIT!”

Step six was to jump. To just do it. To quit.

I finally did it, and it wasn’t nearly as scary as I thought it would be. All of the stuff that I was worried about, that I thought would be so stressful around money, ended up just fine. And I got used to it pretty quickly.

There have, of course, still been some moments of stress. There are moments when I wonder, “Oh shit, when is the next project coming in?” But I think you just learn and get used to that being the life of a business owner sometimes. I don’t know that that ever goes away.

The story isn’t over

This is a work-in-progress story, not a success story. I’m still working on this stuff!

How it’s going

Today, I’m still very frugal, and I pay myself enough to avoid spending my safety net. Everything is going well, and my business is growing slow and steady.

While I’m not where I was before, I haven’t replaced my past salary and maybe never will, but I don’t know if that’s even the goal. I’m happy and free.

Yes, building a business is super hard, but it is so, so nice to work for myself, have that flexibility, call the shots, and just be in control of my own life.

Sure, once in a while, I get the money scaries, but it’s nowhere near as big a barrier as I always thought it would be. I’m so glad that I didn’t let that fear hold me back.

The Takeaways

First: Planning is everything.

If you’re financially cautious and you want to take that self-employment leap, you need to plan yourself into a place where you feel confident you’ll be okay doing so. I think that is what ensured that when I finally did take that leap, it wasn’t that big of a deal because I had done so much preparation.

Second: My journey is my journey, and your journey will be your own.

I want to reiterate that these are my unique circumstances. Your unique circumstances are perfectly awesome, and you can make this happen no matter what situation you’re in. You might go about it all in a totally different way. I would still encourage anyone out there to pursue working for themselves.

Third: It’s not how much money you make, but how much you keep.

A lot of people think you need a high income to get to a place where you can make this move, and that’s just not true. Many people have a high income, but they’re in a ton of debt or don’t keep it or save anything. More important than your income is living below your means and having that cushion so little by little you can build up savings, pay off your debt, or just put yourself in a position to have more breathing room and freedom to make whatever moves you want to make in your life.

Just do it!

Finally, here’s a little something for my fellow risk-averse folks out there. I FEEL you, but maybe put yourself out of your comfort zone. See how it goes 😉 If you’re thinking of diving into owning a business, trust me, you will get used to the ebb and flow of things coming in when they do. You will get used to riding that wave, and it is not as scary as you think.